Political instability in the world

The current political hot spots are the tip of the iceberg created from the desire to break the unipolar world established by the US since the disintegration of the Soviet Union. Conflicts of Russia - Ukraine and Israel - Hamas, tensions in the Red Sea increase the risk of supply chain disruption and the price of raw materials, crude oil, and foodstuffs. According to experts, if these conflicts expand, they will pose huge challenges to the economy of the world. In addition, the US-China trade war is likely to last and increase in scale, putting pressure on trade and foreign investment, increasing costs and slowing the growth momentum of the global economy.

2024 is also the year of “important elections" which shape the new world including elections in the US, Russia, India, and the European Parliament. The results of these elections could lead to changes in domestic and foreign policy, economics, climate change, regulations, and global alliances.

- The US election in November will have the most important implications for the world. Mr. Trump, a candidate of The Republican Party, has stated that he will withdraw from the partnership with Europe, abandon support for Ukraine, and pursue a more confrontational stance with China.

- India, the fastest-growing economy, aims to compete with China to become the factory of the world. The election will be held in May.

- The European Parliament vote in June will be a test for Europe's right-wing populists, who have emerged strongly after the recent win of the Liberal party (PVV) following an anti-Islam and anti-EU policy in the Netherlands.

Global economy slows down

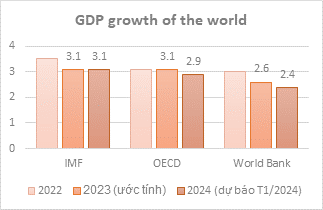

According to OECD assessments, Vietnam is one of the most open economies (based on the ratio of trade to GDP), so the weakness of the world economy also has a significant impact on Vietnam. Recently, some major organizations have shared the same view on the global economic outlook that the growth in 2024 will be relatively modest, especially in developed countries.

Source: IMF, WB, OECD

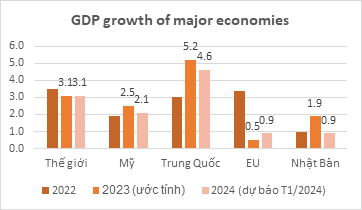

GDP growth in major economies, which are Vietnam’s largest trading partners, will all decrease in 2024, except for the EU, which will have a higher growth rate due to the low base of last year. Declining demand from main export markets will hinder Vietnam's export recovery.

Risks from the real estate industry

The value of corporate bonds due this year is estimated to reach VND 234 trillion (+6.47% yoy), of which the Real Estate industry accounts for more than 41%. In addition to these maturing bonds, the market will face additional burdens from previously extended batches of late-paying bonds, estimated to have a value of 99.7 trillion VND (according to Fiin Group). Most of these bonds come from the Real Estate industry.

The payment pressure of real estate enterprises is expected to be difficult to relieve, as the market has not fully recovered, legal problems continue due to policy delays and businesses operating cash flow need time to rebalance. The expiration of Decree 08 and the return to application of some regulations under Decree 65 from the beginning of 2024 will also create challenges for businesses and increase the risk of late payment.

According to research by the Vietnam Real Estate Association, real estate directly contributes about 15% to GDP with an influence on 40 key industries of the economy. Bank is the main capital supply channel for the economy and credit for real estate accounts for 25% of total outstanding debts. Therefore, the struggles in the real estate market not only bring risks to the banking industry but also to the overall economy. This year is determined to be a pivotal period to measure the market's policy absorption and a test for real estate businesses in the recovery process.

Despite numerous challenges, this year will also be the year Vietnam receives many positive opportunities to become the new dragon of Asia. To be able to take advantage of it, the most important thing is that Vietnam needs to quickly unlock the capital flows and maintain flexibility in the current uncertain world context. (*)

Invest with VPS to receive dedicated support from our seasoned experts:

|

(*) Disclaimer: Opinions in this report reflect the professional judgment of the research analyst as of the date hereof and are based on information and data obtained from sources that we considers reliable. We makes no representation that the information and data are accurate or complete and the views presented in this report are subject to change without prior notification. Clients should independently consider their own particular circumstances and objectives and are solely responsible for their investment decisions and we shall not have liability for investments or results thereof.